Understanding US Inflation: Key Insights from Historical and Current Data

Inflation plays a crucial role in the economic stability of the United States. It affects everything from consumer purchasing power to investment decisions and Federal Reserve policies. By analyzing US CPI inflation data, historical trends, and current inflation numbers, we can gain valuable insights into the country’s economic trajectory.

What is the US Consumer Price Index (CPI)?

The US Consumer Price Index (CPI) is one of the most widely used indicators to measure inflation. It reflects the average change in prices paid by consumers for goods and services over time. The CPI is crucial in tracking inflation trends and helping policymakers make informed decisions about monetary policies.

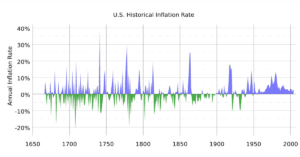

Historical Inflation Rate in the US

The historical inflation rate in the US has fluctuated over the decades due to various economic conditions. Some key periods in US inflation history include:

- The Great Depression (1929-1939): Deflation was a significant issue during this time, with prices dropping drastically.

- The 1970s Stagflation: This period saw high inflation and slow economic growth, driven by oil price shocks and policy missteps.

- The 2008 Financial Crisis: Inflation remained relatively low due to economic contraction and reduced consumer spending.

- Post-Pandemic Inflation Surge: The US saw a sharp rise in inflation following the COVID-19 pandemic, with supply chain disruptions and increased demand pushing prices up.

Current US Inflation Data

Recent US inflation data today provides insights into the ongoing economic situation. Inflation has been influenced by factors such as labor market conditions, global supply chain disruptions, and government fiscal policies. The Federal Reserve closely monitors the US CPI data release today to adjust interest rates accordingly.

US Inflation Rate Data and Economic Impact

The US inflation rate data impacts various aspects of the economy, including:

- Consumer Purchasing Power: Higher inflation reduces the value of money, making goods and services more expensive.

- Investment Decisions: Investors keep an eye on US inflation rate history to make informed choices regarding stocks, bonds, and real estate.

- Wages and Employment: Rising inflation often leads to wage adjustments, but if wages do not keep up, it can reduce consumer purchasing power.

- Federal Reserve Policies: The Fed uses US inflation data release date to adjust interest rates and control inflation.

US Inflation Data Release Date and Its Importance

The US CPI data release today is crucial for policymakers, businesses, and investors. It provides updated insights into inflation trends and helps in making strategic financial decisions. The Bureau of Labor Statistics (BLS) publishes the CPI data monthly, influencing stock markets and economic forecasts.

Future Outlook for US Consumer Inflation

Looking ahead, the US consumer inflation data suggests that inflation trends will depend on factors such as:

- Global Economic Conditions: The international supply chain and trade policies will continue to impact inflation in the US.

- Monetary Policies: The Federal Reserve’s actions on interest rates will determine how inflation evolves.

- Technological Advancements: Automation and efficiency improvements in industries may help stabilize prices in the long run.

FAQs on US Inflation

1. What is the main cause of inflation in the US? Inflation in the US is primarily caused by factors such as increased consumer demand, rising production costs, supply chain disruptions, and monetary policies set by the Federal Reserve.

2. How often is the US CPI data released? The US CPI data is released monthly by the Bureau of Labor Statistics (BLS), providing updated insights into inflation trends.

3. How does inflation affect everyday consumers? Inflation reduces the purchasing power of money, making goods and services more expensive. It also affects wages, interest rates, and savings.

4. What is the difference between CPI-U and CPI-W? CPI-U measures inflation for all urban consumers, covering about 93% of the population, while CPI-W focuses on urban wage earners and clerical workers.

5. Can the Federal Reserve control inflation? Yes, the Federal Reserve influences inflation through monetary policy tools such as interest rate adjustments and open market operations.

6. What has been the highest inflation rate in US history? One of the highest recorded inflation rates in US history was during the early 1980s when inflation exceeded 13% due to energy crises and economic policies.

Conclusion

Understanding the historical inflation rate in the US and tracking inflation data in the United States is essential for making informed financial and policy decisions. By keeping an eye on US inflation data today time, individuals, businesses, and policymakers can navigate economic challenges effectively.